per capita tax in pa

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Earned Income Tax Regulations.

Eu Infant Mortality Rate 2016 Infant Mortality Rate Mortality Rate Fertility Rate

So when Crawford Central School Board members adopted a 678 million 2022-23 budget Monday that eliminated the districts 5 per capita tax it was a significant moment.

. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Act 511 Taxes Flat Act 511 Taxes Proportional Amusement Tax. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Per Capita Tax Roll. Do I pay this tax if I rent. Per capita exemption requests can be submitted online.

What is the Per Capita Tax. PA State Law requires counties to maintain a personalper capita tax roll that lists all individuals by their job title occupation and assessment. West Chester PA 19380-0991 Personal Tax Payment Instructions.

Lynette Willis 814-664-4677 Ext 1206. Both taxes are due each year and are not duplications. Individual Taxpayer Mailing Addresses.

The Per Capita Tax bill is sent in July. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which shall levy such tax shall annually pay for the use of the school district in which he or she is a resident or inhabitant a per capita tax of not less than one dollar nor more than five dollars as may be assessed by the local school district. What is the per capita tax.

The tax is due if you are a resident for. The Real Estate Tax rate for 2020 is 7 mils. Deadline for payment of all personal taxes is April.

City Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year. It can be levied by a municipality andor school district. The school district as well as the township or borough in which you reside may levy a per capita tax.

The school district as well as the township or borough in which you reside may levy a per capita tax. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Links for Individual Taxpayers.

Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions.

With an estimated population of 95112 as of the 2020 census it is the fourth most populated city in the state after Philadelphia Pittsburgh and Allentown. Expand sub-menu Commissions Committees Authorities. You must file exemption application each year you receive a tax bill.

For most areas adult is defined as 18 years of age and older. The list must also include persons who are retired unemployed or persons not currently working. If both do so it is shared 5050.

Who is exempt from PA per capita tax. What is difference between an ACT 511 and ACT 679 Per Capita Tax. Sales Use and Hotel Occupancy Tax.

In other words if you live in an. Exoneration from tax is applicable to the current tax year only. Is this tax withheld by my employer.

What is the Per Capita Tax. Bellwood PA 16617 Phone. What is per capita tax in PA.

ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per capita means by head so this tax is commonly called a head tax.

12000 per annum from the per capita or similar head tax occupation tax or earned income tax or. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Pennsylvania has a 999 percent corporate income tax rate and permits local gross receipts taxes.

Municipalities and school districts were given the. Per capita tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Motor and Alternative Fuel Taxes.

ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the. For most areas adult is defined as 18 years of age or older. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Per Capita means by head so this tax is commonly called a head tax. Act 511 Taxes for Pennsylvania School Districts Glossary of Terms. Per Capita means by head so this tax is commonly called a head tax.

FAQ for Individual Taxpayers. Explore data on pennsylvanias income tax sales tax gas tax property tax and business taxes. Earned Income Tax Information for Employers.

If you pay after the Face Amount due date in November a 5 penalty is added to your taxes until the end of the year. Per PersonPer Capita taxes Issued to any person age 18 or older who resides in the Phoenixville Area School District. For most areas adult is defined as 18 years of age or older.

Both taxes are due each year and are not duplications. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. Per Capita 540 E Pleasant St Corry PA 16407.

Family farm corporation means a Pennsylvania corporation at least seventy-five percent of the assets of which are devoted to the business of agriculture which business for the purposes of this definition shall not be deemed to include. If you pay your bill on or before the discount date in September you receive a 2 discount. Per Capita Tax Act 679 Any person who is 18 years of age or over on or before June 30th of the taxing year must pay this tax.

Pennsylvania has a flat 307 percent individual income tax. There are also jurisdictions that collect local income taxes. The tax is due if you are a resident for any part of the billing cycle.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Reminder to pay your Per Capita tax. The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County.

Access Keystones e-Pay to get started. Not one that saves individual taxpayers much and not one that has the same impact as the 3 percent property tax increase that accompanied the budget but still significant. Act 511 of 1965.

Business Gross Receipts Tax. If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please contact the elected tax collector. It is not dependent upon employment.

This tax does not matter if you own rent or have a child attending the Phoenixville Area School District. Normally the Per Capita tax is NOT.

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Map Usa Map 30 Year Mortgage

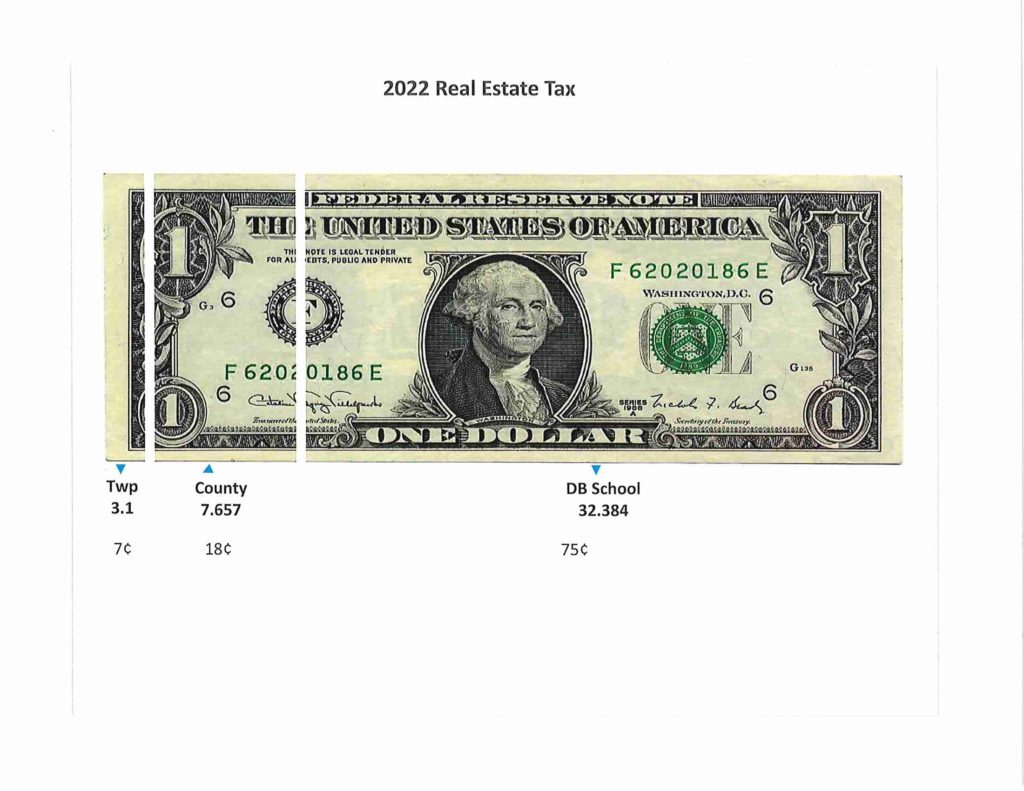

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Maptitude Mapping Software Map Infographic Of Turkeys Raised By State Map Mapping Software Infographic

Taxes Not Fun To Pay But Great Genealogy Records Genealogy Genealogy Records Genealogy History

Information About Per Capita Taxes York Adams Tax Bureau

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Usa E Coli Outbreak Lettuce 2018 197 Family Income Credit Cards Debt Centers For Disease Control And Prevention

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Which States Pay The Most Federal Taxes Moneyrates

Per Capita Tax Exemption Form Keystone Collections Group

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Pin On S S 5 Themes Of Geography

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization